nebraska property tax calculator

Nebraska State Payroll Taxes. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Nebraska Property Tax Calculator Smartasset

Its important to note that some items are exempt from sales tax in Nebraska including prepared food and related ingredients.

. As of 2019 the Nebraska state sales tax rate is 55. Its a progressive system which means that taxpayers who earn more pay higher taxes. If you make 70000 a year living in the region of Nebraska USA you will be taxed 12680.

77-6703There are four new provisions. There are four tax brackets in. Nebraska Income Tax Calculator 2021.

Nebraskas state income tax system is similar to the federal system. Your average tax rate is 1198 and your marginal. For comparison the median home value in Nebraska is.

Now that weve paid Uncle Sam his due lets look at Nebraska state income taxes. The median property tax in Lincoln County Nebraska is 1924 per year for a home worth the median value of 109100. Driver and Vehicle Records.

For comparison the median home value in Lincoln County is. For comparison the median home value in Cass County is. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Ad Enter Any Address Receive a Comprehensive Property Report. LB 181 amends the refundable income tax credit for school district property taxes paid under Neb. Counties in Nebraska collect an average of 176 of a propertys assesed fair.

Unsure Of The Value Of Your Property. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. For comparison the median home value in Buffalo County is.

The Nebraska Department of Revenue DOR has created a GovDelivery subscription category called Nebraska Property Tax Credit Click here to learn more about this free subscription. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. See Results in Minutes.

The requirement in the prior law. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Lincoln County collects on average 176 of a propertys assessed.

Nebraska Salary Tax Calculator for the Tax Year 202223. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and. The state income tax rate in Nebraska is progressive and ranges from 246 to 684 while federal income tax rates range from 10 to 37 depending on your income.

Find All The Record Information You Need Here. Important note on the salary paycheck calculator. You are able to use our Nebraska State Tax Calculator to calculate your total tax costs in the tax year 202223.

The state charges a progressive income tax broken down into. The median property tax in Nebraska is 216400 per year for a home worth the median value of 12330000. Registration Fees and Taxes.

Don T Die In Nebraska How The County Inheritance Tax Works

Colorado S Low Property Taxes Colorado Fiscal Institute

Taxes And Spending In Nebraska

Nebraska Sales Tax Small Business Guide Truic

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Nebraska Property Tax Calculator Smartasset

Hennepin County Mn Property Tax Calculator Smartasset

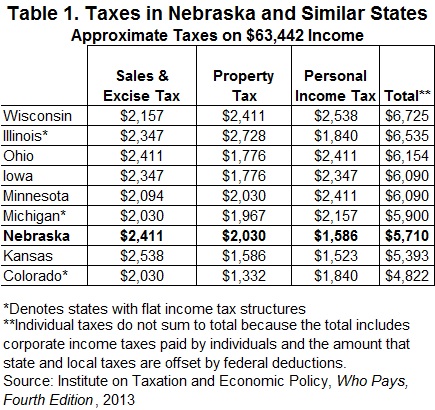

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Policy Brief Typical Family Pays Less Tax In Nebraska Than In Most Similar States Open Sky Policy Institute

Nebraska Property Tax Calculator Smartasset

About Nebraska Personal Property

Get The Facts About Nebraska S High Tax Burden

2022 Property Taxes By State Report Propertyshark

Omaha Property Taxes Explained 2022

Omaha Property Taxes Explained 2022

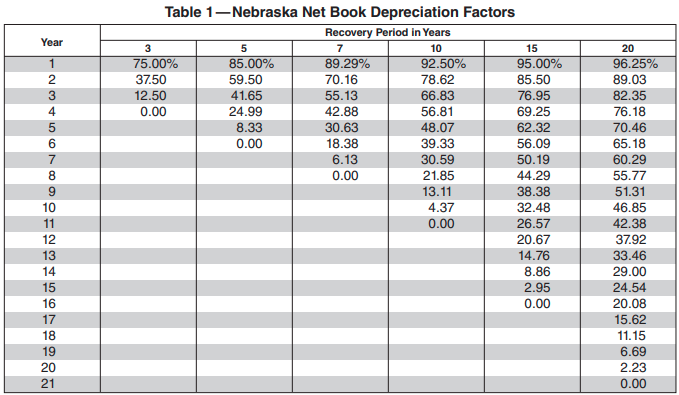

2020 Nebraska Property Tax Issues Agricultural Economics

Taxes And Spending In Nebraska

States With The Highest And Lowest Property Taxes Property Tax Tax States